Form 1099

Form 1099 and Other Business Taxes in 2025

Forms, Deadlines, and Filing Requirements for Form 1099

Understanding tax requirements and deadlines is critical for business owners, especially regarding Form 1099 for 2025. This guide provides an overview of essential tax documents, filing deadlines, and Form 1099 requirements, ensuring you’re prepared for the upcoming tax season.

Important Tax Forms for Business Owners in 2025

Business owners deal with several tax forms, and Form 1099 is one of the most important for reporting non-employee payments. Here are some of the key forms to keep in mind:

- Individual Income Tax Forms: Sole proprietors and independent contractors typically use Form 1040 to report income. If you earn income outside of a traditional salary, you may also need Form 1040-ES to handle estimated tax payments.

- Federal Tax Return Forms: Your business structure determines which form you’ll use. C corporations need Form 1120, partnerships require Form 1065, and S corporations file Form 1120-S.

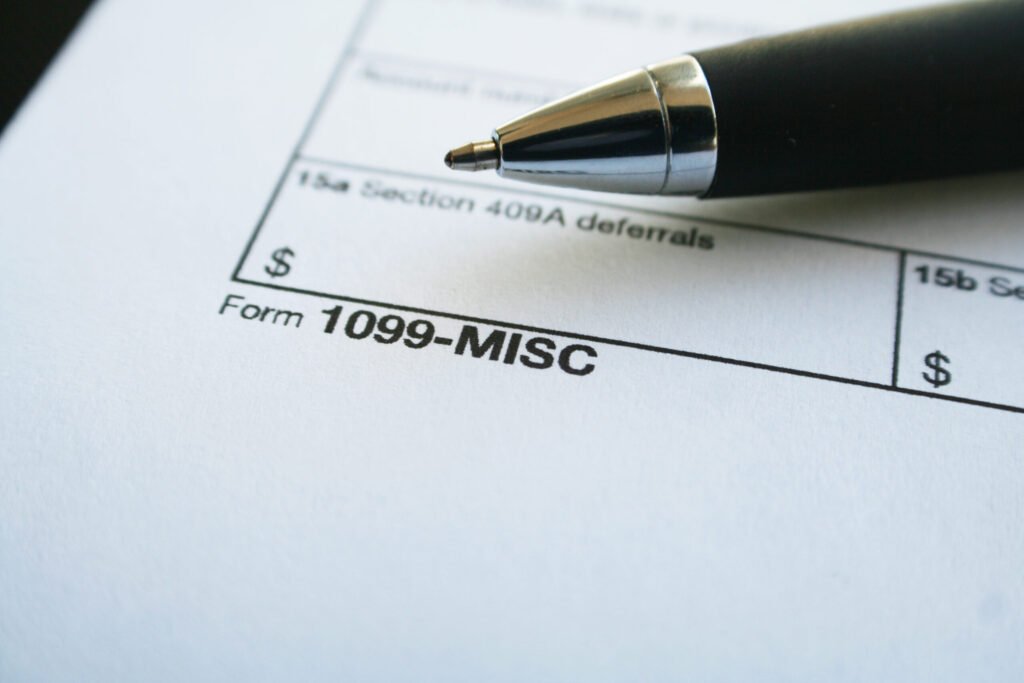

- Forms for Independent Contractors: If you hired freelancers or contractors, you’re required to issue Form 1099-NEC by January 31, 2025, for any payments of $600 or more.

- Employee Tax Forms: Employers must provide W-2 forms to employees, showing wages and withholdings, by January 31. Employees submit W-4 forms, which determine tax withholding amounts.

- Investment Income Forms: Use Form 1099-DIV and Form 1099-INT to report dividend and interest income, with both forms due to recipients and the IRS by January 31, 2025.

Federal Income Tax Forms in 2025

Overview

Selecting the correct tax forms is essential for accurate reporting and avoiding errors. Here’s an outline of some of the most common forms required for tax reporting:

Individual Income Tax Forms

- Form 1040 is the standard form for reporting individual income. It’s typically used by sole proprietors to report both personal and business income and expenses.

- Form 1040-ES helps calculate and pay estimated quarterly taxes, which is important for freelancers and independent contractors.

Forms for Contractors

If you paid any independent contractors $600 or more, you must file Form 1099-NEC by January 31, 2025. This form is crucial for reporting payments to freelancers and other non-employees.

Forms for Employees

Businesses that employ staff provide W-2 forms to employees to summarize wages and tax withholdings. This form is due by January 31, 2025, and helps employees accurately file their own taxes.

Forms for Investment Income

For those with dividend or interest income, Form 1099-DIV and Form 1099-INT report these amounts and are essential for accurate tax reporting.

Federal Income Tax Returns by Business Structure

The IRS requires different forms depending on the business structure:

C Corporations

C corporations file Form 1120 to report income, expenses, and deductions. If your corporation handles stock transactions, Form 1099-B might also be required to report sales.

Sole Proprietorships and Single-Member LLCs

Sole proprietors typically complete Schedule C with Form 1040 to report business income and claim any eligible business expenses.

Pass-Through Entities

Pass-through entities, including S corporations and partnerships, report income on their owners’ personal tax returns. S corporations use Form 1120-S and partnerships file Form 1065.

Deadlines for Form 1099 and Other Tax Forms in 2025

Meeting tax deadlines helps avoid penalties and keeps you in compliance with the IRS. Here are the main dates for 2025:

Form 1099-NEC Due Date

This Form required for payments to contractors, must be issued by January 31, 2025. This deadline ensures timely reporting of non-employee compensation.

Business Tax Deadlines

- March 15, 2025: Partnerships and S corporations file their federal tax returns, or they must file for an extension.

- April 15, 2025: C corporations and sole proprietors must file federal tax returns or request an extension.

Estimated Tax Payments

If you’re required to pay estimated taxes, the deadlines are April 15, June 15, September 15, and January 15.

Staying on top of these dates can help you avoid costly penalties and interest charges.

Penalties for Late Filing and How to Avoid Them

The IRS imposes penalties for late filing and underpayment of taxes, so it’s important to be aware of them:

- Late Filing Penalty: If you miss the deadline, the IRS charges a 5% penalty per month on unpaid taxes, up to 25% of the amount due. This penalty also applies to Form 1099 filings, with fees increasing based on the length of the delay.

- Underpayment Penalty: If you don’t pay estimated taxes as required, you could be subject to additional charges on the unpaid balance.

Filing on time and consulting with a tax professional can help you avoid these penalties and maintain compliance with the IRS.

E-File vs. Paper Mail

The IRS offers electronic and paper filing options, each with its own benefits:

E-Filing

E-filing is the fastest and most accurate method, allowing quick processing and reducing the chance of errors. E-filing is available for most forms, including Form 1099, through the IRS or authorized e-filing providers.

Paper Filing

Paper filing is available for those who prefer it, though it takes longer to process. Make sure your forms are postmarked by the deadline to avoid penalties.

For businesses with complex tax requirements, consulting a tax professional can simplify the filing process of all forms.

FAQ About Form 1099 and Tax Filing in 2025

Here are answers to some of the most common questions about Form 1099 and business tax requirements:

- When Is Form 1099 Due?

Form 1099-NEC must be issued by January 31, 2025, to report non-employee payments.

- What If I Need More Time to File?

If you need an extension, file Form 7004. However, this extension only applies to filing, not to the payment deadline.

- Are There Penalties for Late Form 1099 Submissions?

Yes, penalties apply if you file the Form late. The fines increase based on how overdue the filing is.

Make Tax Season Easier with Professional Help

Tax season doesn’t have to be stressful. For businesses with complex filings, working with a tax professional can provide valuable support. Services like Fatima and Company offer assistance with tax filings, Form 1099 requirements, and overall compliance, allowing you to focus on growing your business.